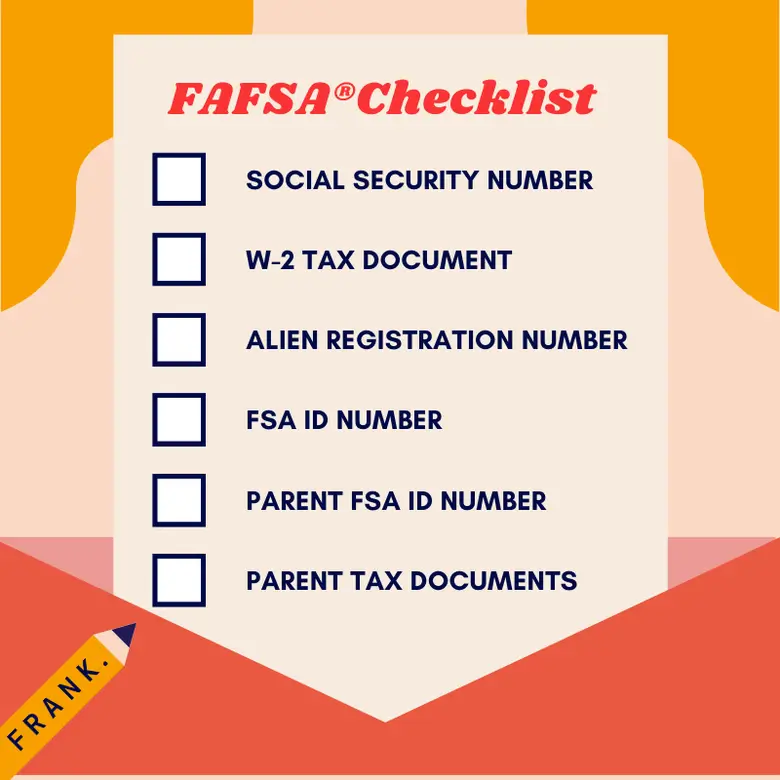

Consult This Financial Aid Checklist as You Prep for the FAFSA

The free application for federal student aid, commonly referred to by its acronym, FAFSA, opens a week from today. This means that students and their families should start gathering the documents they'll need to complete their FAFSAs accurately.

You'll Need Tax Returns, FSA ID and More to Complete the FAFSA

Make sure you have the applicable items shown in the above checklist nearby before you begin working on the FAFSA, Haile advises. To create the FSA ID, you'll go to studentaid.gov/fsaid and click "Create an Account" on the right-hand side of the page.

Financial Aid Is Often First-Come, First Served

If you're wondering why it's important to get your FAFSA completed sooner rather than later, you should get to know the basics of how financial aid is distributed. In some cases, financial aid is given out on a first-come, first served basis, Haile said. "Colleges and universities are allotted a certain amount of funds by the federal government to distribute to students that file the FAFSA. The earlier you file, the more likely you are to get the full amount of FAFSA aid." In addition, the type of financial aid that is available may be imbalanced for later filers. Grants and scholarships could be awarded earlier, leaving only loans for later filers in some situations.

Important: "While schools don't necessarily run out of financial aid money, there is a potential you won't be awarded a full aid package by applying after most students are already awarded full amounts," Haile said. "We suggest applying on October 1 to maximize your financial aid."

Understand "Need-Blind" Vs. "Need-Aware" Policies

When researching colleges, you may notice the terms "need blind" and "need aware," which refer to whether your financial need could be considered in your admissions decision. With need-blind admissions, the colleges do not take your financial situation into consideration when making the admissions decision. But need-aware schools do have the option of factoring your financial need when deciding whether to admit you.

Therefore, some students who think they may not qualify for financial aid wonder whether they should list their need-aware colleges on the FAFSA, since including these schools on their financial aid applications could make a difference in the admission outcomes.

"While we would normally suggest putting every school you're applying to on the FAFSA, you have some options in the case of a need-aware school," Haile said. Here's the upside and the downside in a nutshell, she said:

- Upside: Informing a need-aware school that you are not applying for financial aid may potentially increase your acceptance chances.

- Downside: You are likely to get a better financial aid offer if you are accepted to a need-aware school than a need-blind school.

"So you can leave the school off of your FAFSA and inform the school you are not going to request financial aid, but there's a downside to choosing that path," Haile said. "In most other cases, especially for students reliant on financial aid, we suggest putting every school you're applying to on your FAFSA."